Maximizing Profit in Forex Trading: A Comprehensive Guide

Forex trading can be a highly lucrative venture for those who are equipped with the right knowledge and strategies. In this article, we will explore essential strategies for maximizing profit in Forex trading. We’ll provide insights into market trends, trading techniques, money management, and additional resources like forex trading profit Trading Platform QA that can enhance your trading experience.

Understanding Forex Trading

The foreign exchange market (Forex) is one of the largest financial markets in the world, characterized by its high liquidity and round-the-clock trading. Unlike stock markets, the Forex market operates 24 hours a day on weekdays, providing opportunities for traders worldwide to engage at any time. To profit in Forex trading, you must first understand the various factors that influence currency movements, including economic indicators, geopolitical events, and market sentiment.

Essential Strategies for Maximizing Profit

1. Develop a Trading Plan

Every successful trader has a trading plan that outlines their goals, risk tolerance, and strategies. A well-defined trading plan helps eliminate emotional decision-making and keeps you focused on your objectives. Your plan should include:

- Specific currency pairs to trade

- Your entry and exit strategies

- Risk management techniques

- Performance evaluation criteria

2. Choose the Right Trading Strategy

There are numerous trading strategies available, and selecting the one that aligns with your trading style is crucial. Some popular strategies include:

- Day Trading: Involves opening and closing trades within the same day, aiming for small profit margins.

- Swing Trading: Focuses on capturing short to medium-term market moves, holding positions for several days or weeks.

- Scalping: Involves making numerous trades throughout the day to profit from small price changes.

- Position Trading: Long-term strategy where trades are held for weeks, months, or even years, based on fundamental analysis.

3. Leverage Risk Management Techniques

Risk management is vital for long-term success in Forex trading. Ensuring that you manage risk properly can protect your trading capital from significant losses. Key techniques include:

- Setting Stop-Loss Orders: Always use stop-loss orders to limit potential losses on every trade.

- Position Sizing: Calculate the appropriate position size to avoid overexposing your account to any single trade.

- Diversification: Don’t put all your capital into one trade or currency pair; diversify your investments to spread risk.

Utilizing Technical and Fundamental Analysis

Technical Analysis

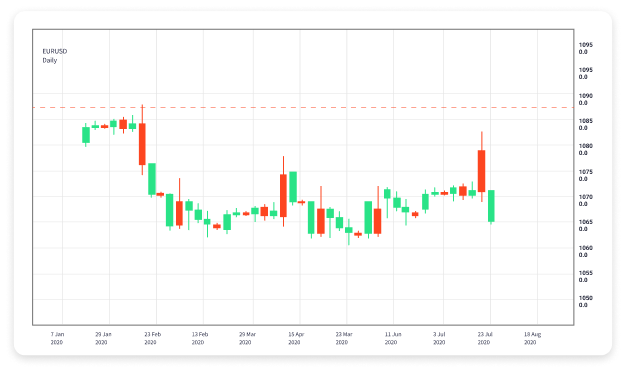

Technical analysis involves analyzing price movements and trading volumes to predict future price movements. Traders use various tools such as charts, indicators, and patterns to identify trends and make trading decisions. Familiarize yourself with:

- Chart patterns (e.g., head and shoulders, triangles)

- Technical indicators (e.g., moving averages, RSI, MACD)

- Support and resistance levels

Fundamental Analysis

Fundamental analysis examines economic indicators, news releases, and geopolitical events to determine currency values. Understanding the economic landscape can provide valuable context for your trading strategies. Key indicators to track include:

- Interest rates

- Employment figures

- Gross Domestic Product (GDP)

- Inflation rates

Staying Informed and Continuous Learning

The Forex market is constantly evolving, making it crucial for traders to stay informed about trends and developments. Continuous learning through resources such as books, webinars, and online courses can enhance your trading skills. Additionally, consider participating in trading communities for sharing insights and strategies with other traders.

Leveraging Trading Platforms and Tools

Choosing the right trading platform can significantly impact your trading experience and success rate. Look for platforms that offer:

- User-friendly interfaces

- Advanced charting tools

- Automated trading options

- Educational resources

Consider utilizing demo accounts to practice your strategies without the risk of real capital. This way, you can familiarize yourself with different tools and strategies before trading with real money.

The Psychology of Trading

The psychological aspect of trading is often overlooked, yet it plays a pivotal role in a trader’s success. Emotional control, discipline, and patience are essential qualities to cultivate. Recognizing psychological barriers, such as fear of losses or overconfidence after wins, can help you maintain a balanced approach and execute your trading plan effectively.

Conclusion

While Forex trading presents substantial opportunities for profit, it also involves significant risks. By implementing a well-developed trading plan, utilizing effective strategies, enhancing your analytical skills, and managing your emotions, you can position yourself to maximize your profits in the Forex market. Additionally, leverage the educational resources and trading tools available to support your trading journey. Ultimately, success in Forex trading is a combination of knowledge, practice, and the ability to adapt to ever-changing market conditions.